There is no definitive answer as to what the appropriate business structure for your specific business is, however, key considerations include:

- Legal Risk

- Personal Asset Protection

- Tax minimisation

- Administrative Costs

- Operational requirements

- Ownership Structure

- Exit Plans

- Financing needs

- Labour model

New business owners should sit down with their Accountants to evaluate the pros and cons to the different entity structures available.

The most common legal structures available to new Australian businesses include:

Sole Trader

The key advantage to operating as a sole trader is that it is simple and inexpensive to set up and low ongoing compliance costs. Unfortunately, this is where the benefits end, the drawback to this structure is it is not a separate legal entity, so there is no protection against an owner's personal assets. Other considerations include:

- Allows you to use your individual tax file number (TFN) to lodge tax returns.

- Doesn’t require you to use a sperate business bank account (But recommended you do)

- Financial records need to be kept for a minimum of 5 years.

- Owners are personally liable for tax and income derived.

A popular structure for simple businesses (hobby-based businesses) operating in an industry not expected to be inherently risk. An example could be a basic lawn mowing business.

Partnership

A Partnership is a legal relationship between two or more people who carry on a business venture as a partnership. However, partners remain jointly responsible for the debts and liabilities of the business.

A partnership should have a partnership agreement in place which sets out how the partnership operates. The partnership will have its own tax file number and lodge its own tax returns.

The costs of setting up a partnership are relatively low, however, if there is a disagreement between the partners the separation process can be difficult and costly. Other considerations unique to a partnership include:

- Unlimited personal liability

- Each partner is taxed at their individual tax rate.

- Unlikely to be eligible for Government Grants

- All profits are split between both partners.

Companies

A company (Pty Ltd) is its own legal entity and a great structure for businesses looking at high growth and scalability. In normal circumstances (Shares are paid in full and directors do not act fraudulently) the directors and shareholders of the company are not at personal risk making it an attractive business structure.

A company can easily issue shares to raise capital through equity, while there are moderate costs to set up and maintain a company the company structure provides flexibility and protection that makes it a popular structure for new start-ups. Other characteristics of a company:

- Liability to shareholders limited.

- Easy to transfer ownership.

- Shareholders can be employed by company.

- Favourable taxation rates

- Increased reporting and compliance costs

- Profits distributed to shareholders are taxable.

Trust

There are two types of trusts that can be used to operate a business in Australia being a Discretionary (Family) Trust or a Fixed Unit Trust. A trust will have an individual or corporate trustee who controls the trust (distributes profits to beneficiaries of the trust, as per the trust deed).

A drawback to a trust is all the profits must be distributed, the trust cannot retain its profits, or it will be taxed at the top marginal tax rate of 49%. The trust is one of the more complicated and costly structures to set up and maintain. Other considerations and characteristics of a trust include:

- Limited liability is possible if a corporate trustee is appointed.

- Increased privacy compared to a company.

- Trust income is generally taxed as income of the individual it is distributed to.

- Income is distributed largely at the discretion of the trustee.

- The trust deed limits the trustee's powers.

- Can restrict traditional financing options due to the complexities of a trust.

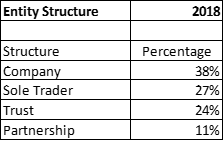

Not surprisingly, a company structure is the most popular business structure in Australia (2018). The company structure provides moderate compliance costs, limits the liability of shareholders, and provides flexibility when scaling or raising finance.

While there are online providers that provide cost-effective options for start-up owners to register a company or trust such as Ecompanies it is recommended that you talk with your Accountant or trusted financial advisor before locking in your business structure.